Recent Posts

- jQuery attrAugust 12, 2021

- jQuery mouseenterAugust 9, 2021

- jQuery ToggleclassAugust 6, 2021

- jQuery attr

TDS stands for Tax deducted at source. It is a part of income taxes which is deducted at the very source of the income. i.e. as and when income is generated tax is deducted on such income at a specified rate.

It is basically a means by which the government collects the Tax in advance from the assesses.

Accordingly, whenever a person(deductor/payer) liable to make payment for specified nature of activities such as contract, commission, salary, rent, interest, winning on lotteries, interest, professional or technical fees etc.

At the time of payment shall deduct a prescribed percentage of taxes at the very source i.e. at the time of making payment itself he shall pay the reduced amount to another person (deductee/payee) after deducting taxes at the source.

TDS is deducted if the payment exceeds a certain threshold limit. Different rates of TDS have been prescribed for different kind of payments under the Income Tax Act 1961.

Who is Deductor/Payer and Deductee/Payee?

Deductor/Payer- A person who makes payment to the payee/ deductee after deducting tax at source and deposit the same with the account of government. The responsibility of depositing and filing return lies on deductor. After filing the return he shall also issue TDS certificate to the deductee which shall furnish as a proof of credit for the deductee that tax has been deducted on his income.

Deductee/Payee- It is the person to whom payment is made after deducting tax at source. TDS deducted can be adjusted against the income tax, if any becomes payable or claim as a refund by the deductee only if he files the Income tax return.

Example- Kartik enters into contract with Manoj and paid him Rs. 32000. He shall deduct tax at source @1% on Rs.32000 i.e. Rs.320 and pay the balance amount of Rs. 31680 to Manoj. TDS of Rs.320 deducted by Kartik shall be deposited by him with the government.

Manoj may claim Rs.320 deducted on his income as a refund or may be adjusted against his income tax liability, if any become payable at the time of filing ITR.

When TDS to be deducted?

Tax at source shall be deducted

Earlier of the following date

a) At the time of payment either in cash, cheque, draft on any other mode

OR

b) At the time of crediting such income to the account of the payee in deductor’s books of accounts.

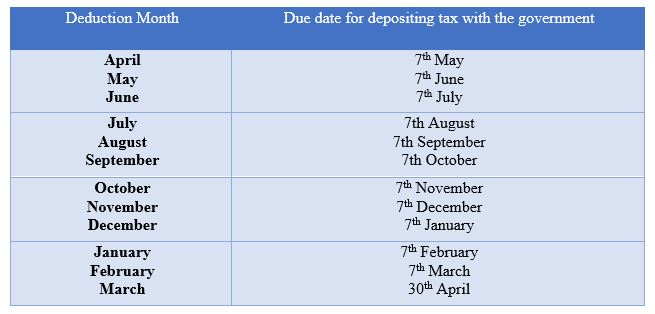

Due date for payment of TDS to the account of government

The tax deducted on the payment shall has to deposited with the government on the 7th of the next month from deduction.

Due date for TDS payment

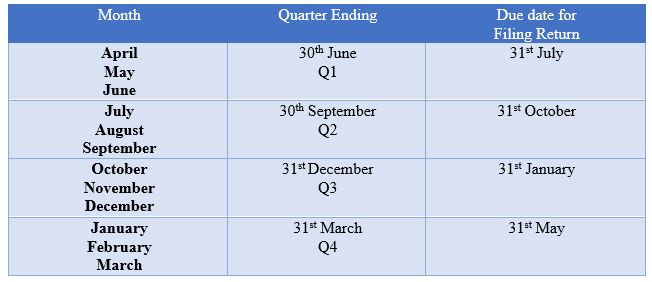

Due Date of filing TDS Return

Due date of TDS Return

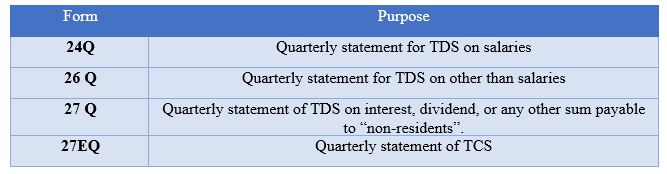

TDS Return Forms

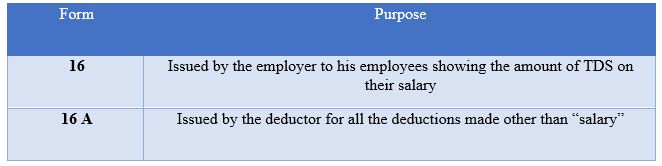

TDS Certificate

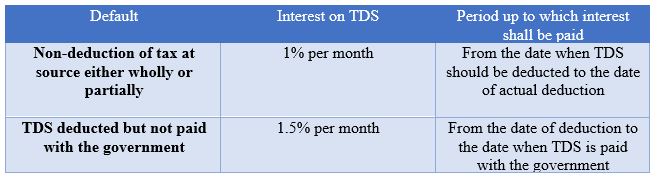

Interest on late deduction or late deposit of TDS u/s 201 A

In case a person does not deduct tax at source or after deducting tax at source does not deposit it with the government, he shall pay an interest on the TDS amount as follows:

Penalty on non payment of TDS

Case1- Non-deduction of TDS

Example: – An amount of Rs. 1,00,000 paid to Manoj on 04.05.2019 under contract without deducting tax at source. Tax is deducted on 25.08.2019.

Defaulting months

04.05.2019 to 25.08.2019- 4 months

Interest calculation

Rs.1,00,000*1%*4 months= Rs.4000

Case 2- Tax deducted but not paid with the government

Example: – An amount of Rs. 1,00,000 paid to Manoj on 04.05.2019 under contract after deducting tax at source. Tax is deducted and paid on 26.12.2019.

Defaulting months

04.05.2019 to 26.12.2019- 8 months

Interest calculation

Rs.1,00,000*1.5%*8 months= Rs.12000

Late Filing Fees on Non-Filing of TDS Return u/s 234 E

Under Section 234 E of Income Tax Act 1961, late filing fees of Rs.200 per day shall be paid until the return is filed. However, in any case this fee shall not exceed the amount of TDS

When Late Filing Fees is less than TDS

Example: – HHI Ltd. Files the TDS return of financial year 2019-20 for quarter 3 (Oct-Dec) on 05.05.2020 for an amount of Rs. 1,00,000.

In this case, the due date of filing return was on 31st January 2020 but it was filed on 05-05-2020

Default period shall start from 1st Feb 2020 to 5th may 2020 i.e. 95 days

Late filing fees shall be Rs. 200* 95 days= Rs.19,000 since it is less than the amount of TDS.

When Late Filing Fees is more than TDS

Example: – HHI Ltd. Files the TDS return of financial year 2019-20 for quarter 3 (Oct-Dec) on 05.05.2020 for an amount of Rs. 10,000.

Here, due date of filing return was on 31st January 2020 but it was filed on 05-05-2020

Default period shall start from 1st Feb 2020 to 5th may 2020 i.e. 95 days

Late filing fees shall be Rs. 200* 95 days= Rs.19,000

However, the late filing fees can not exceed Rs. 10,000 the actual tax deducted.

Penalty under section 271H for non-filing of TDS/TCS Return on due date

Minimum penalty is Rs.10,000 and which may extend up to Rs.1,00,000. This penalty is in addition to the penalty prescribed u/s 234E

Want to know more? visit our website

Computer

Accounting Software

Address

Mohali Career Point,

SC-130 Top Floor, Phase 7 Mohali, 160059

MCP is the right place for best computer Courses institute and advance Courses in Mohali and Chandigarh.The Complete Programming Academy can change your life – providing you with the knowledge, skills, and performance in a second language which helps you to excel in your job.You can also Contact us for 6 month industrial training institute in Mohali.