Recent Posts

- jQuery attrAugust 12, 2021

- jQuery mouseenterAugust 9, 2021

- jQuery ToggleclassAugust 6, 2021

- jQuery attr

GST return is a statement of information which person registered under GST files electronically on the GST portal on the prescribed due date. Different dates and different types of returns are prescribed for different taxpayers.

In this blog, we will discuss about all the GST returns filed under GST laws. Let’s discuss them as follows:

Types of GST Returns

GSTR-1 – Statement of outward supplies

FORM GSTR-1 is a statement of the details of outward supplies (that is sale of goods or provision of services) of goods or services both. The detail of outward supply include details of invoice, debit note, credit note, advance received, advance adjusted and revised invoice issued in relation to outward supplies made during any tax period.

TYPES OF GST RETURNS

It is to be filed either monthly or quarterly depending on the turnover of the business of the preceding year.

TYPES OF GST RETURNS

Annual Turnover up to Rs.1.5 Crores- Taxpayer has the option either to file return either monthly or quarterly. Due date is 31st of the month succeeding the quarter.

Annual Turnover above Rs.1.5 Crores- GSTR-1 has to be mandatorily filed on a monthly basis, 11th of the next month is the due date of filing return.

The GSTR-1 has to be filed even if no supplies has been made during the period.

Taxpayers who need to file the GSTR-1 TYPES OF GST RETURNS

- All registered taxpayers with an annual turnover greater than 1.5 crores must mandatory file GSTR-1 except

- Composition dealer

- Compounding taxable person

- Input service distributers

- Taxpayer liable to deduct TDS

- Taxpayers liable to collect TCS

- Suppliers of OIDAR (Online Information and Database Access or Retrieval Services)

GSTR 2- Detail of Inward Supply i.e. Purchases

Every registered taxable person has to furnish details of inward supply of taxable goods or services or both effected during the tax period. This return has to be filed even if there is zero transactions. However, since the inception of GST, filing of this return is suspended.

TYPES OF GST RETURNS

Due date of filing of GSTR-2

- The due date for filling GSTR-2 is 15th of the following month

- To correct any error you have a 5 day gap in between GSTR-1 and GSTR-2 filling.

GSTR-2A -Read only document

It contains all the inward supplies of goods or services or both made from the registered suppliers. It is a read only document and cannot be edited. This document gets auto populated once the supplier uploads the details in GSTR-1. In other words, GSTR-2A enables the recipient to verify the details uploaded by the supplier in GSTR-1. Also the recipient could accept, reject, modify or keep the invoice pending using the said details. However, such changes are used by recipient in GSTR-2.

GSTR-3- Summary Return (Suspended)

GSTR-3 is a monthly summary return containing the details of outward supplies, inward supplies, and input tax credit claimed along with the tax liability and taxes paid. However, the filing of this return is suspended since the inception of GST It contains two parts that is Part A and Part B.

Part A of the return shall be electronically generated on the basis of information furnished through return in form GSTR-1, FORM GSTR-2, and based on other liabilities of preceding tax periods.

Part B contains the tax liability, interest penalty paid and refund claims from cash ledger if any. It is also get auto populated; the system will compute the tax liability on the basis of GSTR-1 and after adjustment of input tax credit as claimed in GSTR-2.

GSTR -3B Outward supTYPES OF GST RETURNS plies alongwith Input tax credit

In order to ease the burden on taxpayer, tax authorities have introduced a simple return form called as GSTR-3B. GSTR-3B is a monthly self-declaration return field by a taxpayer by the 20th of the next month. GSTR-3B discloses supplies made during the month along with GST to be paid, input tax credit claimed, purchase on which reverse charge is applicable, tax liability ascertained and taxes paid.

The GSTR-3B filed by all registered taxpayer except Input service distributors, Composition dealers, Supplier of online information and database access or retrieval services. (OIDAR). Taxpayers must file form GSTR-3B even if there is no transaction in the month.

Due Date of GSTR-3B

To be file by the 20th of the following month. For example, GSTR-3B for July should be filed by the 20th of the august should be filed by the 20th of September and so on.

GSTR-4/CMP-08 Return for taxpayer registered under the composition levy

TYPES OF GST RETURNS

GSTR-4 is replaced with CMP-08. CMP-08 is a return that has to be filed by a composition dealer. However not all business will be eligible to registered under GST Composition scheme– only those business entities, whose annual turnover is up to R.1.5 crore and who also fulfill other specified criteria can be entitled to be registered under the composition scheme.

Due date of CMP-08

Composition dealers are required to file a quarterly GST return using GSTR-4 by the 18th of the succeeding quarter in which the return being filed.

GSTR-5 Return for non- resident foreign taxable person

A non-resident taxable person files a simplified return when they have done the business transactions in India in form GSTR-5 for every calendar month. This return includes details pertaining to:

- Inward Supplies

- Outward Supplies

- Any interest, penalty fees etc.

- Tax payable

- Any other amount payable under the act

Thus a non-resident taxable person is not required to file annual return. He just needs to file a monthly return in FORM GSTR-5. This return can be filed either electronically through common portal or facilitation center notified by the commissioner.

Due date to file GSTR-5

The detail in GSTR-5 need to file within a time period that is earlier of within:

- 20 days after the end of the calendar month.

- 7 days after the last date of validity of the registration

GSTR-5A Returns by Online Information Database Access and Retrieval Services Provider

This return is filed by OIDAR (Online Information Database Access and Retrieval Services Provider) outside India to an unregistered person in India. this return is to be filed even if there is no business for the tax period i.e. Nil Return

Due date of GSTR-5A

20th day of the month succeeding the month.

GSTR-6 Return of an Input Service Distributor

The GSTR-6 is a monthly return form required to be furnished by an input service distributor for distribution of Input Tax Credit. It contains the detail of ITC received and distributed by an ISD and also contains all documents issued for distribution of ITC and manner of distribution of such credit against all the relevant tax invoices. This return is filled by every ISD; even it is a nil return.

Due date of filling

Form- GSTR-6 is filed by the 13th of the succeeding month

GSTR-6A- Details of Supplies

GSTR-6A is auto drafted, read only form for receiver for the inward supplies. This form is generated automatically based in on the details furnished by suppliers of an ISD in form GSTR-1. This form contains details pertaining to the supplies against which credit is received for distribution. It also includes the details debit note and credit note received during the current tax period.

GSTR-7 Returns filed by authorities for tax deducted at source

The GSTR-7 is a return to be filed by the person who is require to deduct tax at source when receiving goods or services form Central or State Government/Department or local authority or government agencies. GSTR-7 contains the detail of TDS deducted, TDS liability payable and paid, and TDS refund claimed if any etc.

Due date of Filing

Filling of GSTR-7 for a month is due on the 10th of the following month in which tax has been deducted at source. For e.g. Due date for filling GSTR-7 for October is 10th November

GSTR-8 Detail of supply effected through E-Commerce Operator and the amount of tax collected

GSTR-8 is a monthly return form to be furnished by all e-commerce operators who are required to deduct TCS under GST. Form GSTR-8 will show the details of supplies effected through the e-commerce platform and the amount of TCS collected on such supplies and also the goods or services returned through it.

The supplier can take the input tax credit of such TCS deducted by the E-commerce operator. The amount of such TCS will be reflected in form GSTR-2A of the supplier

Due date of Filing Return

On or before 10th of the month of succeeding the calendar month in which tax has been collected at source.Further, the amount of tax collected by ECO (TCS amount) is required to be deposited by the 10th of the month succeeding the calendar month in which tax has been collected at source.

GSTR-9 Annual return for a normal taxpayer

Gstr-9 is an annual return to be filled by the businesses registered under GST. It consists the detail of outward and inward supplies made or received during the relevant previous year under different tax heads CGST, SGST and IGST. It consolidates the information furnished in monthly or quarterly return. However, this annual return is optional for perons having annual turnover up to Rs. 2 crores.

Who are not required to file GSTR-9?

All registered taxable person under GST must file GSTR-9. However, the following person are not required to file GST-9:

- Taxpayers opting composition scheme

- Casual taxable person

- Input service distributors

- Non-resident taxable person

- Person deducting TDS

- Persons collecting TCS

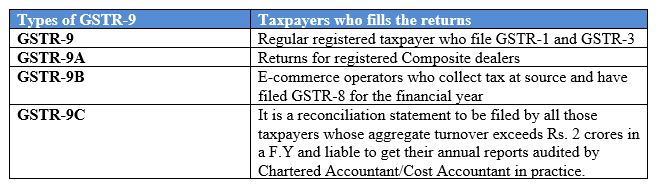

Types of GSTR-9

There are 4 types of annual return under GST law:

Types of GSTR-9

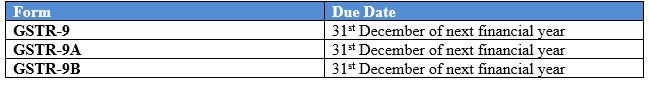

Due date for filling GST annual return FORM GSTR9, GSTR-9A and GSTR-9B

GSTR-10 Final return

A taxable person whose GST registration is cancelled or surrendered has to file a return in form GSTR-10 called as a final return. This is statement of stocks held by which taxpayer on day immediately preceding the date form which cancellation is made effective. This return intended to provide details ITC involved in closing stock to be reversed/paid by the taxpayer.

Due date to file GSTR-10

GSTR-10 should be filled within three months of the “date of cancellation” or “date of order of cancellation”, whichever is later.

GSTR-11 Details of inward supplies furnished by the one who have UIN and claiming a refund

It is return form to filed by every registered person who has been issued a UIN to get tax credit refunds under the GST for all the inward supplies of taxable goods/services bought in India

Due date of Filing Return

The GSTR-11 due date is the 28th of the month following the month in which an inward supply is received by the UIN holders. Thus, GSTR-11 filing is not a monthly process, but a case-to-case basis filing, depending on supplies made.

Late fees and Penalty

- If the taxpayer fails to file the return before the due date, it shall attract penalty of Rs 200/-per day, Rs.100 for CGST and Rs.100 for SGST/UTGST starting from next day of the due date of filling the return.

- This penalty is subject to maximum of Rs.5000, No late fees on IGST

- Interest of 18% shall also be applicable on the outstanding tax from the next day of the due date of filing return to the date of actual payment.

Computer

Accounting Software

Address

Mohali Career Point,

SC-130 Top Floor, Phase 7 Mohali, 160059

MCP is the right place for best computer Courses institute and advance Courses in Mohali and Chandigarh.The Complete Programming Academy can change your life – providing you with the knowledge, skills, and performance in a second language which helps you to excel in your job.You can also Contact us for 6 month industrial training institute in Mohali.