Recent Posts

- jQuery attrAugust 12, 2021

- jQuery mouseenterAugust 9, 2021

- jQuery ToggleclassAugust 6, 2021

- jQuery attr

GST is an indirect tax which came into effect on 1st July 2017. With the introduction of GST many indirect taxes such as CST (Central Sales Tax), VAT (value Added Tax), Excise duty, service tax, entertainment tax, entry tax etc. have been subsumed under GST. It was introduced to create one national market by replacing all form of indirect taxes.However, there are still some indirect taxes which are outside the purview of GST such as alcohol for human consumption, petroleum products, Aviation turbine fuel, entertainment tax levied by local bodies, real estate sector on the sale or purchase of immovable property.

- GST is an indirect tax levied/charged on the supply of goods or services or both.

Example-1 A labor earning Rs. 200 day bought a Packet of biscuit, tooth brush, and a soap costing Rs. 10, Rs. 12, Rs.20 respectively. He might not be aware but he has already paid tax on the purchase of that products in spite of his low wage.

- Tax paid at the time of purchases shall be available to set off/ deduct from the output tax liability payable at the time of sales.

Tax charged by the seller is his output tax liability and from whom it is charged i.e. from purchaser shall become the Input Tax Credit hereinafter referred as ITC for purchaser.

Example-2 Mr. Kanwar sold goods to Mr. Madhav for Rs. 15000 and charged GST on the above goods Rs. 1800.

Rs.1800 becomes the Output Tax Liability for Mr. Kanwar and the same Rs. 1800 becomes the Input tax Credit (ITC) for Mr. Madhav which he’ll be eligible to set off against his Output Tax Liability.

When Mr. Madhav will sell the above goods further say for Rs. 20,000 and charged GST on the same Rs. 2400

Net tax Liability of Mr. Madhav

Output Tax Liability 2400

Less: -Input Tax Credit 1800

Net Tax Liability 600

- GST is a Value Added Tax that is only the margin added by the Second, third and so on stage dealer shall be charged to tax.

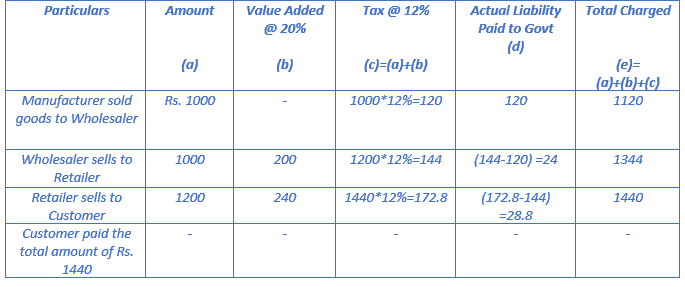

Example- 3

GST is a value added tax

Proof that GST is a Value Added Tax

Here in above example 3 Wholesaler added value of Rs.200, GST rate is 12%. GST Payable on value added is Rs.200*12%=24 (Refer col (d) of Ex-3)

Retailer added value of Rs. 240, GST payable on value added is Rs.240*12%=28.8 (Refer col (d) of Ex-3)

4. No Cascading or double taxation effect of taxes paid at the time of purchase from other state unlike earlier tax regime.

Example 4

Kartik Enterprises registered under Punjab VAT bought goods from Delhi for Rs. 1,00,000 after paying Central Sales Taxes @ 2% i.e. Rs.2000. He after having the possession of goods sold them in Punjab for Rs. 2,00,000 after paying VAT @ 5%, i.e. Rs.10,000

Net Tax Liability under Earlier Tax Regime

Tax paid at the time of sales Rs.10000

Add: Tax paid at the time of purchases Rs. 2000

Total Tax Liability Rs.12000

Had, it be other way around in GST his Net Tax Liability would have been Rs. 8000 since under GST even if goods are bought from other state tax paid at the time of purchases shall be available for” Input Tax Credit”

Net Tax Liability under GST

Tax paid at the time of sales Rs.10000

Less: Tax paid at the time of purchases Rs. 2000

Total Tax Liability Rs.8000

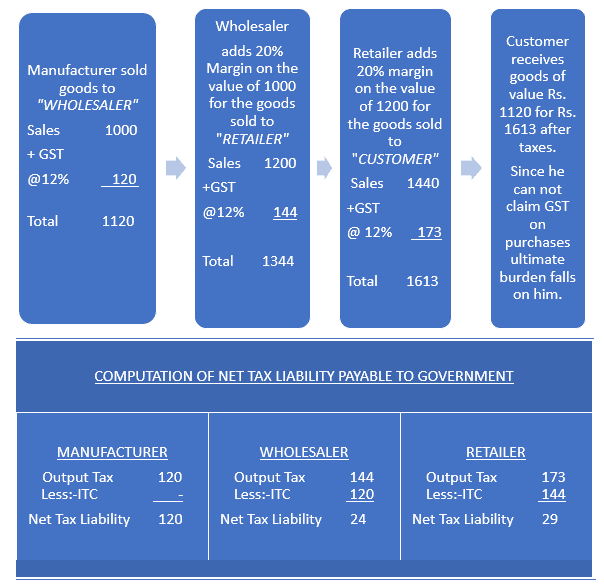

5. It gives continuous seamless inflow of credit of taxes paid from manufacturer to wholesaler to retailer and so on

Example-5

Seamless inflow of Input tax credit

6. Ultimate burden of taxes falls on consumer.

Example- In example no. 5 goods which has the value of Rs. 1120 received by the consumer for Rs. 1613 after taxes. so here the ultimate burden of taxes falls on consumer.

Computer

Accounting Software

Address

Mohali Career Point,

SC-130 Top Floor, Phase 7 Mohali, 160059

MCP is the right place for best computer Courses institute and advance Courses in Mohali and Chandigarh.The Complete Programming Academy can change your life – providing you with the knowledge, skills, and performance in a second language which helps you to excel in your job.You can also Contact us for 6 month industrial training institute in Mohali.